Nowadays, you can pretty much do anything with your smartphone. The idea of “pay with your phone” seems to be up and coming. You can pay for Starbucks drinks with your Starbucks app on your phone. Convenience is the goal.

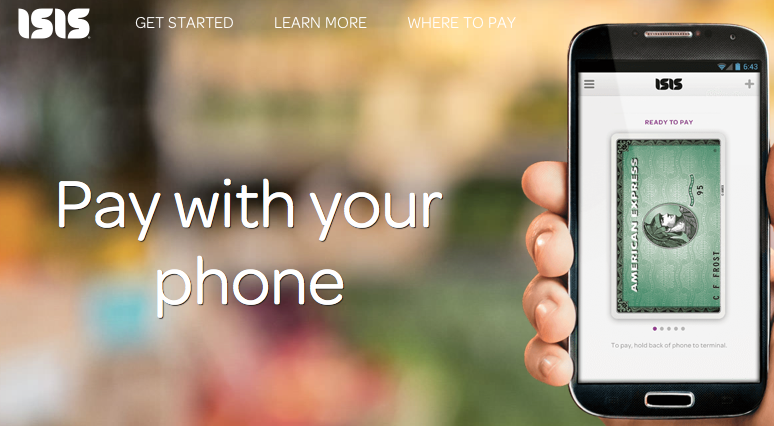

The ISIS wallet is essentially a phone app where you store certain allowed credit cards to your ISIS account, and then you can use any of those credit cards when making a “contactless purchase” at a merchant. There’s a few videos from the ISIS site which I thought I would include in this post which explain all this. They are very short.

https://www.youtube.com/watch?v=yHMlk-nyYFo

https://www.youtube.com/watch?v=MvABszQelGM

https://www.youtube.com/watch?v=tH5RWt6HdKk

The idea is cool because that’s fewer plastic cards that you have to carry in your wallet. When you make a purchase, you just choose the card you want from your screen and pay.

There are certainly limitations to this.

Limited cards:

- All Amex personal and OPEN business cards are eligible

- Amex Serve is supported (see below why this is good)

- Chase Freedom, Sapphire, Slate, and JP Morgan Palladium are supported

- Wells Fargo Visa credit card is supported

Limited Merchants:

The issue with the idea is payments have to be contactless. I think people are still used to the idea of swiping cards. Not every merchant has contactless technology yet.

Limited Phone Carriers:

Isis currently only works with Verizon, AT&T, and T-mobile. I have Sprint, so I can’t get ISIS.

So, far the only good thing I see about ISIS is that Amex Serve is compatible with it. In addition, having ISIS increases your online Amex Serve monthly load limit with credit cards to $1500 as opposed to only $1000 without ISIS. As a result, you would be able to do an additional $6000 in manufactured spending.

Although the idea is great, I still think ISIS Wallet has a long way to go. It would be nice to see the ability to add any credit card from any bank, as well as more compatibility with phone carriers. If they supported Sprint, I would get it just for having an increased limit for Amex Serve.