BankDirect Mileage Checking has been one of my favorite ways to earn American Advantage miles over the past few years. There is nothing easier than watching miles pile up with no effort depending on the balance in the account. The current structure of the BankDirect Mileage checking account allows one to:

Earn 100 AAdvantage® miles per month for every $1,000.00 of the average daily collected balance in your Mileage Checking Account up to the first $200,000 on deposit. Average daily balances above $200,000 earn 25 AAdvantage® miles per $1,000 on deposit, WITH NO CAP!

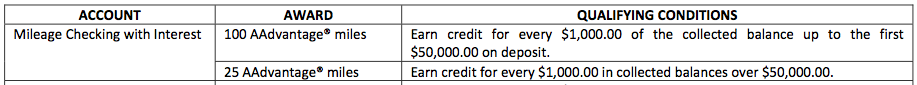

However, effective June 1st, 2013, BankDirect is decreasing the potential to earn miles. Now, you can only get 100 miles per month for every $1000 up to the first $50,000. Average daily balances above $50,000 will earn 25 AAdvantage miles per $1000.

To give an example of the impact, suppose you currently have $200,000 (there are people that do) in the BankDirect checking account, you would earn 240,000 miles for a total cost of $144 (BankDirect charges a $12 fee per month).

Effective June 1st, you would be earning only 105,000 miles for $144 dollars if you kept $200,000 in the account. That is a 135,000 mile decrease, the equivalent of a first class ticket from US to Asia on Cathay Pacific, a significant value!

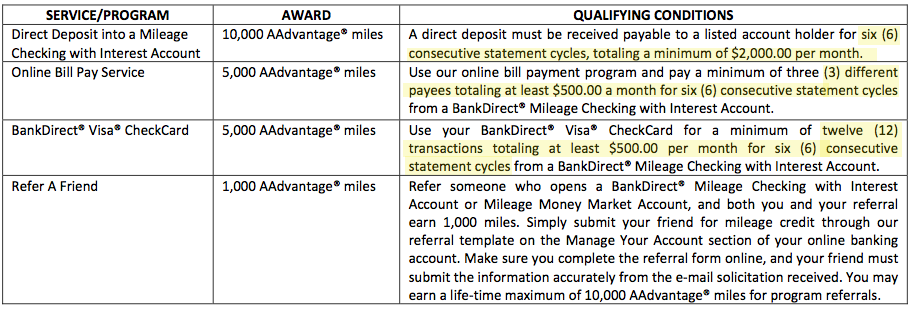

It seems the other bonuses for signing up, using bill pay, direct deposit, and visa check card will still exist (potential for up to 22,000 AAdvantage miles), but there seem to be minimum dollar requirements that were not there before (see below).

So, I guess BankDirect seems to be cracking down on the high rollers. I suspect that people with over $50K in the bank are going to move their money elsewhere starting June 1st. But, I’m sure BankDirect has done its research to make sure they don’t take a huge hit. I will keep my account open, but to me, it doesn’t make sense to keep more than $50K in the account. I wonder what change BankDirect will make next? See the full changes here.

What are your thoughts on this BankDirect change?

HT: Gary Leff (View from the Wing)

Consider moving money over to Fidelity as they offer American, Delta, and United bonuses (15K miles for a $25K deposit, 25K miles for a $50K deposit, 50K miles for a $100K deposit). Technically, you have to keep your money parked there for 6 months, so you should be able to earn 2 bonuses (on different airlines) in a year. A $50K balance at BD gets you 60K AA miles at a cost of $144 for a year, whereas a $50K balance at Fidelity gets you 50K miles at no cost.

Fidelity may certainly be the way to go if you have money sitting around earning next to nothing in this low interest environment.