I previously wrote about the basics of the Flexperks Travel Rewards Signature Visa from US Bank. The point of that post is that you can great value from flexperks points (up to 2 cents per point) when redeemed for flights.

The 3 key things about the card are:

- No annual fee first year, $49 thereafter

- 2x FlexPoints on the category you spend the most on (gas, groceries or airlines) and most cell phone expenses during each billing cycle.

- 3x FlexPoints on qualifying charitable donations.

With the assumption of each flexperk point having a maximum value of 2 cents each, the 2x and 3x category bonuses equate to a value of 4 cents or 6 cents. That’s really great!

Racking up free flights by using the card to make Kiva donations:

Using the Flexperks Travel Rewards Signature Visa to make donations on Kiva can really rack up the flexperks points. To illustrate a simple example, supposed you make charitable donations to Kiva in the amount of $6,666.67, you would end up with 20,000 points since you are earning 3x. That’s equivalent to a free flight.

Keep in mind that you are going to get these “charitable donations” back in the form of cash over time. I always like to mention that there is risk involved of losing some money. However, in my personal experience with Kiva, that loss has been minimal. You can read more about Kiva here.

The idea here is the same as making 5x cash back on Kiva charitable donations with the US Bank Cash Plus card.

In an extreme example, supposed you loaned $2000 per month to Kiva (not for everyone), you would rack up $24,000 in spend and 72,000 flexperks points. With $24,000 in spend, you earn an additional 3500 flexperks points which you can use to negate the annual fee (if you chose). With the signup bonus of 20,000 points (after completing minimum spend), you would be sitting on 95,500 points equal to $1910 in flight redemptions. That’s a pretty good return on loaning lots of money.

Maximizing the redemption of your flights:

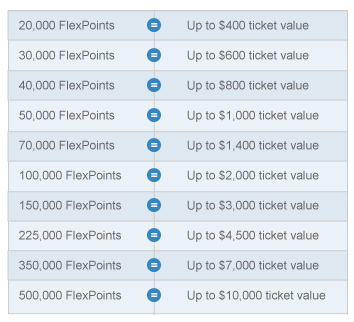

To get the maximum value of each point, it would be ideal to redeem for exactly the allowed ticket value. For example, you get the most benefit when you redeem 20,000 points for $400 ticket. However, there might be a flight that is only $300, in which you may be losing a bit of value.

However, according to this post from FrequentMiler, your ticket does not have to be a plain roundtrip ticket. You can have multiple segments, or even 2 roundtrip tickets (booked as multiple segments) as long as the total is below $400. In addition, perhaps an economy ticket is $300, but business class ticket is $400. You might as well book the business class ticket. Not only will you get maximum value from your points, but you will likely get double miles from the airline for the business class ticket.

The Verdict

With the right strategy, you can certainly rack up lots of free flights with the US Bank Flexperks Travel Rewards Signature Visa. If you don’t want to pay the annual fee the second year, you could likely downgrade to the US Bank Cash Plus card.