I am always thankful to Chase for allowing me take many nice trips with points earned from their credit cards. They get a lot of my business, mostly because Ultimate Rewards points are valuable, versatile, and their cards offer solid bonuses.

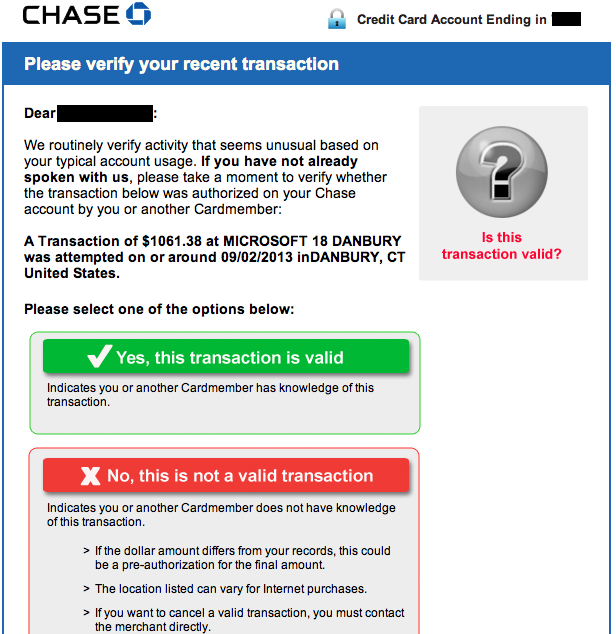

More recently, I have another reason to thank them. While on vacation, I received an email from Chase with the subject “Chase Fraud Alert.” I was shocked to see that someone was trying to charge $1061.38 on my Chase Freedom at Microsoft in Danbury, CT.

I really had no idea where or how my card had been compromised. However, I quickly called Chase, and they informed me that the transaction above was attempted 3 times and was declined all three times. They recommended to close the card and that they would send me a new one.

I was impressed that Chase not only detected the fraud, declined the transactions, and was able to notify me quickly before any damage was done. I’m guessing the email was automated, but even then, it’s nice to know that the bank you do business with is watching your back along with its own. I would be curious to learn more about their tactics for recognizing credit card fraud.

On a different note, a buddy of mine was a victim of credit card fraud with a Capital One card. He had notified Capital One that he would be traveling to Brazil on specified dates. When he returned, he noticed that his credit card had thousands of dollars in grocery store charges in Brazil well after the dates that he had been traveling. So, Capital One knew he was traveling on specific dates, yet allowed transactions to occur even afterwards. I’m guessing that wouldn’t have happened if he had used a Chase card.

So, another reason to be thankful to Chase. Have you ever been a victim of credit card fraud? How so?