It’s always exciting to sign up for a credit card, get 50000 or more points and use the points for amazing trips. Perhaps the best use of miles and points is premium cabin redemptions where you can get fantastic value for them. That all makes sense if you are constantly earning and burning to keep your miles and points balances low. But, what if you don’t travel that often and have too many miles or points.

If that’s the case, the points are just sitting around not collecting any interest and constantly on the verge of devaluation. We have seen some serious devaluations recently, perhaps the most significant of them being with American Airlines.

Could it then make sense to redeem these points, even at a 1 cent per point and invest the money you earn?

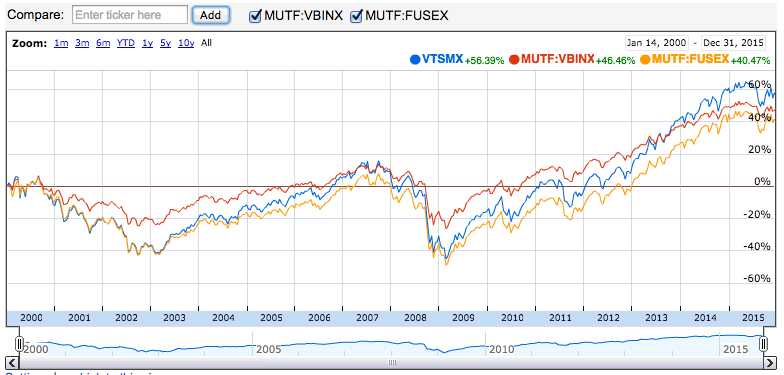

For example, 50000 Ultimate Rewards points are worth $500 in cash. Invested wisely, that money could be put into one of the best index funds such as the Vanguard Total Stock Market Index (VTSMX). Other solid options include the Vanguard Balanced Index Fund (VBINX) or Fidelity Spartan 500 Index (FUSEX). Most of these have an initial minimum investment, but after that you can contribute any small amount at any time.

Now, I know people would argue that Ultimate Rewards points are worth way more than 1 cent and they are absolutely right. You can certainly get more than a one cent redemption when transferred to Southwest, United, Hyatt etc. But until those points are actually redeemed, they are not worth anything.

How about the recent Citibank 50000 Thank You Points offer for opening a Citigold checking account. That was worth at least $500, and it could have been worth even more to you if you used a credit card to fund the account.

Over time, these $500 contributions could easily add up to thousands of dollars growing exponentially. If you trust the greatest investor’s advice on index funds, then investing the money should not feel like a risk.

What are you doing with the cashback from your credit cards?

It’s easy to earn 2% cashback with Fidelity Amex or the Citi Double Cash. That’s money that you didn’t have in the first place and the bank is just giving you that for spending on your credit card. Take that cash back and invest it in index funds on a monthly basis. Be disciplined and don’t just spend the money.

The dividend earned in these index funds can be reinvested automatically if you wish, helping your account grow even more. Make sure you are not paying any transaction fees for the purchase of these funds.

The banks continue to give out free money in the form of credit card bonuses, cash or points for checking and savings accounts, and cash back from using your credit card.

The best use of points still involves redeeming them for high value travel. However, if you have excess points or no upcoming use for the points, cash them out and invest the money in index funds. With appropriate balance, you can get the banks to fund your aspirational travel and make you wealthy along the way.

this has to be one of the most surreal, comical posts I’ve ever encountered in the travel points-o-sphere. So how’s that index fund doing for you this year? So you want us to utterly WASTE 50k of Chase UR points on a $500 Vanguard index fund?

It’s great that I made you laugh. The intent was investing if you are sitting on too many miles and points. If you have a use for them, then by all means use them for high value trips. My index fund has been doing great for years by the way, and I keep adding to it.