A couple of months ago, I tried to cancel the Citi American Airlines Platinum Mastercard since the annual fee was coming up. Instead, they were able to give me a retention bonus of 3000 miles for spending $500 in 3 months.

I called again recently to cancel the card since I didn’t really want to pay the $95 annual fee. They didn’t have any new retention offers for me this time, perhaps because it was too soon since the last one. They weren’t giving me any options really.

I remember reading this post a while back from Rapid Travel Chai which said that it could be possible to downgrade to a Citi Dividend card which gives the potential to earn up to $300 back per year.

I then suggested to see if they would let me downgrade the card to one with no annual fee. The rep asked me if I had anything in mind? I asked if it was still possible to get the Citi Dividend card. He said they weren’t accepting new applications, but were allowing downgrades. He also gave me the option of the downgrading to the new Citi Cash card, a 2% cash back card. I chose the Dividend card, primarily for the 5% cash back categories.

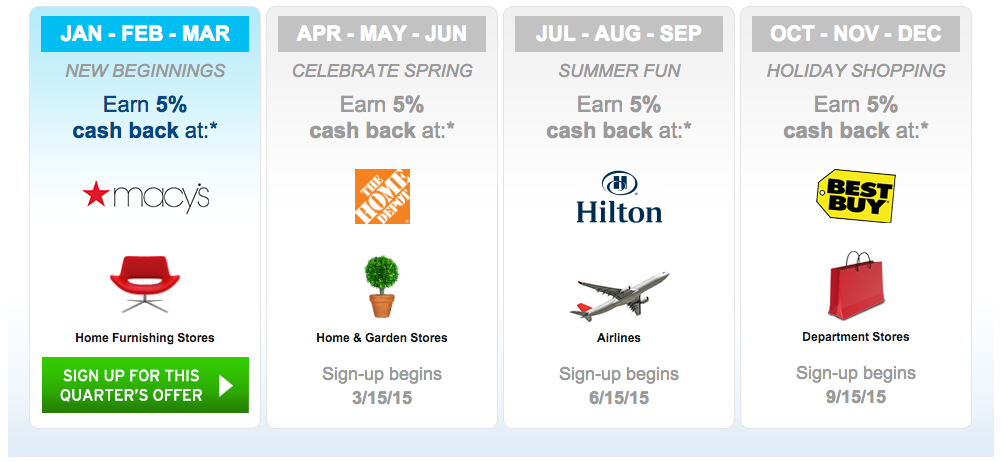

The Citi Dividend card is an old card. It’s mainly a competitor of the Chase Freedom and Discover card which offer rotating 5% categories. It has no annual fee, gives 1% back on all purchases, but most importantly, 5% back on rotating categories.

The vital part of the 5% categories that you can earn up to max of $300 year, but there are no quarterly caps like $1500 quarterly spend cap with the Freedom or the Discover card. If the right category comes along (drugstores), you can max it out by buying Visa gift cards although you would lose out 1% on the gift card fees. Unfortunately, drugstores is not a category for 2015.

I don’t really care about the 1% back, since I have a Fidelity Amex which gives 2% back.

Since Citi has phased this Dividend card out on their website, so you won’t find a link or an application page.

Overall, I think the Citi Dividend card is a great card to have since it has no annual fee, and gives you the ability the earn $300 back annually, a gem for those who know how to manufacture spend. It is also possible to have more than 1 of these cards (Mastercard and Visa).

So, if you want this card, ask for downgrading from a Citi Card with an annual fee.